In the 2024 financial year alone, the Australian Taxation Office (ATO) issued nearly 27,000 Director Penalty Notices (DPNs), valued at $4.4 billion.

Tax debts increased by $40 billion from 2018 to 2023, forcing a shift in the ATO’s approach to collecting tax debts following the pandemic. This shift is particularly evident in the DPN space.

This article explores the key aspects of DPNs and how directors can navigate their responsibilities.

What is a DPN?

A DPN allows the ATO to pierce the ‘corporate veil’ and make directors personally liable for company debts by issuing DPNs.

DPNs relate to debts for:

- Pay-as-you-go Withholding (PAYGW)

- Goods and Services Tax (GST)

- Superannuation Guarantee Charge (SGC)

The ATO issues a DPN to your Australian Securities and Investments Commission (ASIC) registered address, regardless of the ATO address on their file.

If you have received a DPN, you only have 21 days from the date of issue to act before you become personally liable.

There are two types of DPNs: lockdown and non-lockdown.

What is a lockdown DPN?

A lockdown DPN is issued if:

- Business Activity Statements lodgements are over three months overdue, and/or

- SGC Statements are lodged after their due date.

The only option available to escape personal liability, is to cause the debt to be repaid within 21 days of the DPN issue date.

What is a non-lockdown DPN?

A non-lockdown DPN is issued if:

- BAS lodgements not overdue, and/or

- SGC Statements are lodged by their due date.

A non-lockdown DPN provides options to be actioned within 21 days of the DPN issue date to avoid personal liability. Those are:

- Cause debt to be repaid

- Appoint an external administrator as either a:

• a voluntary administrator;

• a small business restructuring practitioner; or

• a liquidator.

Our experienced Turnaround and Restructuring experts can help you understand:

- the difference between the above external administrator appointments and

- the risk to your personal assets.

What if I ignore a DPN?

You will be personally liable for the debts the DPN relates to if you do not act in accordance with the DPN within 21 days of the DPN issue date.

The ATO can seek to recover tax debts through other avenues including:

- Issuing garnishee notices*;

- Offsetting directors’ tax credits against the DPN debt; or

- Initiating legal proceedings against directors and/or the company (such as initiating bankruptcy or liquidation).

*A garnishee notice can be issued to any person, third party or organisation that holds money for or on behalf of an entity which owes money to the ATO (i.e. a bank or debtors). Requiring the recipient to pay money directly to the ATO without your consent.

I’m a new director, is it the old director’s issue?

New directors can be held personally liable for tax and super debts incurred prior to their appointment if they don’t ensure within 30-days of their appointment:

- The company pays the amount, or

- An administrator is appointed to the company, or

- A small business restructuring practitioner is appointed to the company, or

- The company is placed into Liquidation.

Undertake due diligence prior to taking a new director appointment to ensure you are not personally exposed.

I’ve resigned as a director, am I off the hook?

Picture this: you resigned as a director years ago, your wealth has increased, you’ve moved on.

You can still be held personally liable for tax and super debts that fell due or were incurred while you were a director.

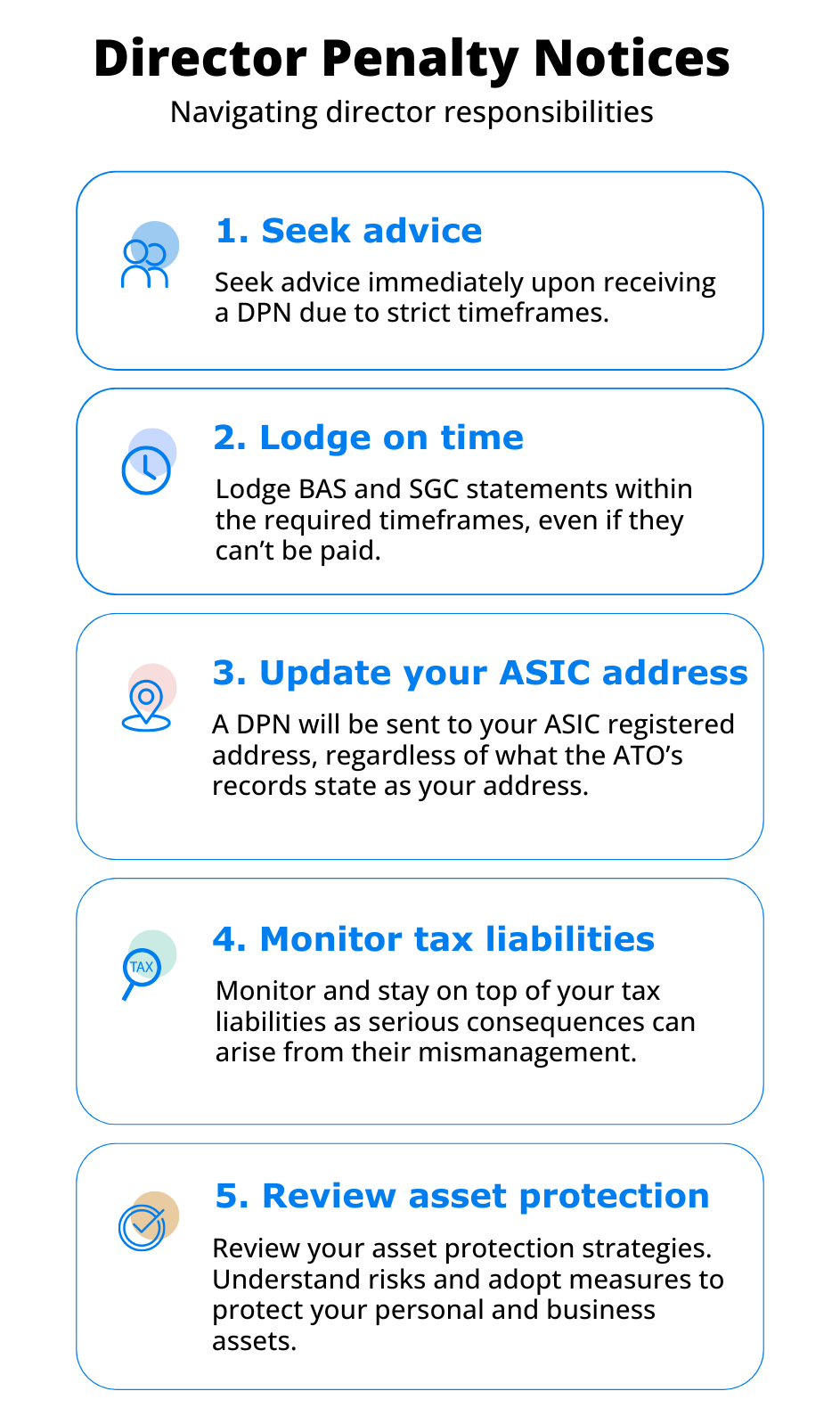

Key takeaways

Understanding DPNs and their implications is essential for protecting your personal assets and ensuring your company meets its obligations. By acting quickly and seeking the right advice, directors can manage this challenging aspect of corporate governance more effectively.

Contact Pilot

If you would like assistance, contact Cameron Woodcroft or your Pilot advisor on (07) 3023 1300.