From 1 January 2021 a simplified restructuring process is available to eligible small businesses. Businesses and their advisors are being encouraged to prepare now and contact our qualified Small Business Restructuring Practitioners (“SBRPs”).

The process will allow small businesses to access a single, streamlined process while allowing the owners to remain in control of their business.

With temporary COVID-19 relief measures relating to statutory demands and insolvent trading liability coming to an end on 31 December 2020 increased pressure will be placed on companies and their directors.

Who is eligible for small business restructuring?

Businesses must meet the following criteria to be eligible to enter the new restructuring process.

Eligibility criteria:

- Business must be operated through an incorporated entity;

- Liabilities must be no more than $1 million;

- The Company must be insolvent or likely to become insolvent; and

- The small business restructuring or simplified liquidation processes must not have been previously used by the director or the Company.

Before issuing a restructuring plan to creditors, all taxation lodgements must be up to date and any employee entitlements (wages and superannuation) due and payable must have been paid.

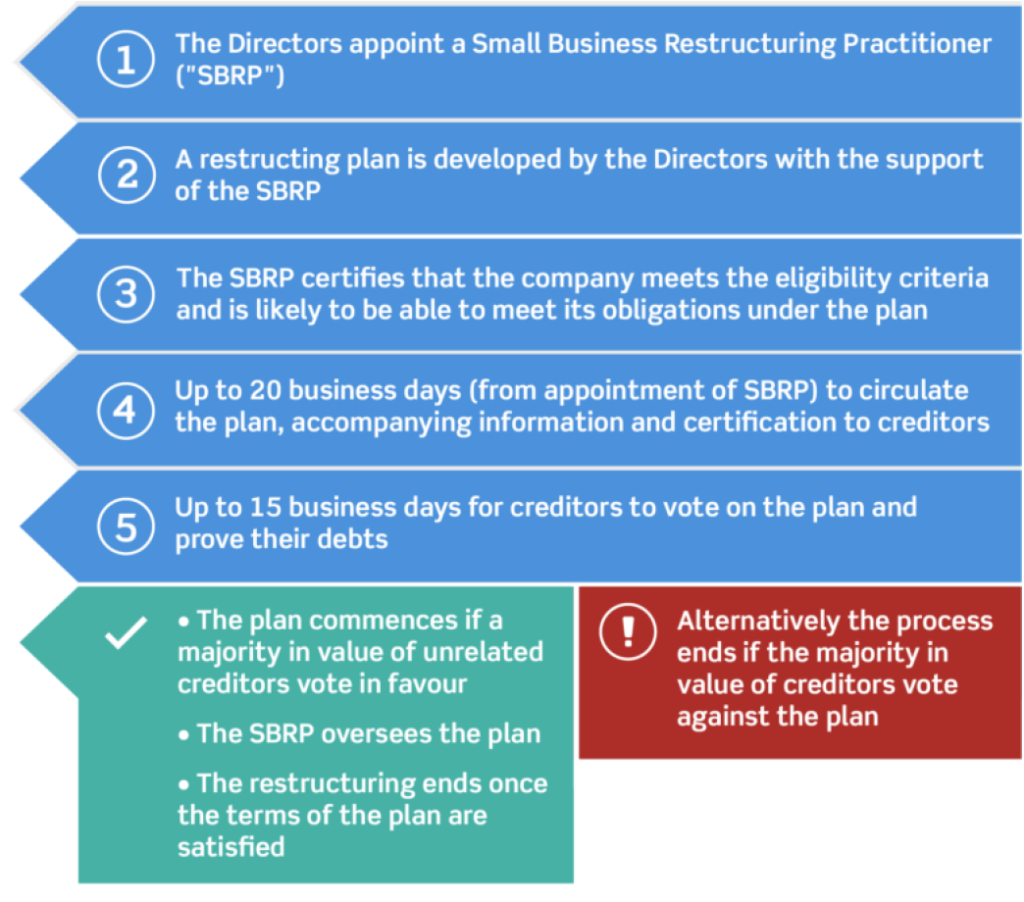

How does the new process work?

What are the benefits of the new process?

- Cost-effective process to restructure existing debts

- Business remains under the control of the directors

- Unsecured and some secured creditors are prohibited from taking actions against the company

- Moratorium on enforcing director’s guarantees

- During small business restructuring insolvent trading laws do not apply if the debt is incurred in the ordinary course of the Company’s business or with the consent of SBRP

- The business has protection from ipso facto clauses

How can Pilot Partners help?

Pilot Partners understands and supports small business. Our SBRPs are qualified to explain all of the options available to small businesses in challenging circumstances.

We will work with you to identify:

- The current financial position of the business

- The root cause of the problem and what solutions are available

- Likely support from major stakeholders in the business

- The correct business restructure for the business

Talk to Bradley Hellen, Nigel Markey or your Pilot advisor to see if the new Small Business Restructuring process is appropriate for you as a small business, or for your client if you are an advisor.