Employees in the public hospital system are fortunate to be able to salary package expenses by forgoing part of their pre-tax salary in return for their employer paying the expense on their behalf.

Our medical team can help you with salary sacrifice arrangements that utilise concessions in the medical industry to help you get more out of your salary and potentially reduce the amount of tax you pay.

Fringe benefits tax for hospital employees

A special fringe benefits tax (FBT) exemption cap applies to public hospital employees as follows:

| Payments | FBT Exemption Cap |

| Payments subject to GST | $8,172 |

| Where payments are GST free | $9,009 |

The cap applies to an FBT year, which runs from 1 April to 31 March. Once the cap has been exceeded, FBT is payable at 47%. This cost is usually passed on to the employee to pay from the employer.

What can be Salary Sacrificed?

A variety of expenses can be salary sacrificed including:

- rent or mortgage payments;

- utilities;

- health insurance premiums;

- non-work related memberships (including gym memberships);

- motor vehicle expenses; and

- expenses for holidays.

If items such as professional memberships are salary sacrificed, these expenses cannot be claimed as a deduction on your income tax return as they have been paid using pre-tax income. Therefore it is best to salary sacrifice expenses that are not able to be claimed as a tax deduction.

How does it work?

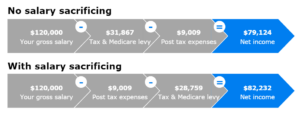

The salary sacrificed expense is paid from pre-tax income. This reduces your taxable income and the tax withheld on salary payments, and therefore increases the cash received each pay. This is illustrated in the example below:

Salary sacrificed expenses are reported on your PAYG Summary as “Reportable Fringe Benefits”. Reportable Fringe Benefits are included in your adjusted taxable income, which is used to calculate your HELP debt repayment, Medicare Levy Surcharge and private health insurance rebate on your tax return.

Learn More

It’s important to seek advice before commencing a salary sacrificing arrangement. To find out your tax benefit from salary sacrificing or to check your current situation is working for you, please contact Kristy Baxter or Angela Stavropoulos or your Pilot advisor on 07 3023 1300.