New reporting requirements for employers

Now is the time to get your business ready with employers of 20 or more employees required by law to report via Single Touch Payroll (‘STP’) from 1 July 2018.

For employers with 19 or fewer employees, the requirement to use STP will commence on 1 July 2019.

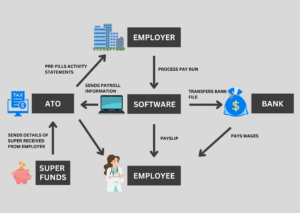

STP is a government initiative to assist employers with providing payroll information to the Australian Taxation Office (ATO) on areal time basis through a simplified reporting system.

All relevant payroll information, such as Pay as you go (PAYG) withholding tax and superannuation for employees, are reported to the A TO in real time. By streamlining the business reporting obligations for employers, potential errors or omissions that occur in traditional reporting methods will be minimised.

How will Single Touch Payroll work?

STP will work in conjunction with an approved business management software, such as MYOB and Xero. When a payment is processed to an employee, your software will generate a bank file for your bank to make the payment and a payslip for you to issue to your employee. At the same time, the employee’s salary or wages, tax withheld and super amounts will be sent directly to the ATO by your software.

The ATO will collate the data for all your employees and automatically pre-fill your activity statements at labels W1 “Total Salaryand wages” and W2 “Amount withheld from payments”. For employers who are large with holders, the ATO has removed these labels all together on the activity statements.

The ATO will use this payroll information is to ensure that employees’ super entitlements have been made correctly and in a timely manner. Data matching will occur when the employees’ super funds lodge their members’ contributions information to the ATO.

How will this change the way I report?

By streamlining how employers are reporting their employee payment details, and storing all the relevant information in one central location, other users of the information will be able to benefit in the following ways:

- Employers can view their current PAYG withholding liability through the Business Portals.

- Employers will not be required to issue payment summaries to employees.

- Employers will not be required to lodge the annual payment summary statement to the ATO.

- For employers who are small to medium with holders, their activity statements will be pre-filled with the

- PAYG tax withholding information.

- For employers who are large with holders, they will no longer be required to report salary and wages information on their activity statements.

- Employees will be able to view their tax and super information via myGov.

- Employees will be able to access the annual payment summaries via myGov.

Payments that cannot be reported

There are certain types of payments that cannot be reported under STP and are generally not paid as part of your regular pay run, or the recipients are not your employees, such as:

- Independent contractors

- Staff provided by employment agents

- Department of Human Services

- Investment bodies and managed investment funds

You will be required to continue with the existing reporting obligations to the Commissioner in relation to these withholding payments.

What if I make a mistake?

STP allows employers to correct payroll information that has been previously sent to the ATO. For example, employers may have misclassified certain payments such as salary sacrifice amounts, or they may have under or overpaid an employee.

Fixing employee details with no additional payment

If you wish to correct an employee’s year to date amounts, where no additional payments is required (i.e. correcting classification of salary and wage item), you may do so in the next pay cycle within the employee record. Alternatively, your software will allow you to attend to the fix via an update event. This will be the only option if the errors were detected after the end of the financial year.

Fixing employee payment subject to withholding

In situations where additional or reduction in payment to an employee is required, the ATO will allow you to make this adjustment within the employee’s next pay, even though it may not fall within the same reporting period. If this is the case, manual adjustments will be required to the pre-filled amounts at labels W1 and W2 of your activity statements.

How do I prepare for Single Touch Payroll?

To make sure that you will be ready for STP, we recommend you undertake the appropriate steps to prepare for implementation:

Speak with your software provider

- Check if they offer STP.

- Check if they have a deferred start date if this function is not yet available.

- Check what support they offer for clients transitioning to STP.

Speak with your tax professional

- Ask how they can help with your implementation.

- Check if they can assist with applying for a deferral or an exemption.

Review your business processes

- Head count your employees on 1 April 2018 to check if you are required to start the implementation on 1 July 2018.

- Educate your payroll staff to ensure they are aware of the changes.

- Check if you can consolidate payroll duties and processes due to less reporting requirements.

- Identify any payments that cannot be reported under STP.

Contact Pilot

If you would like to learn more about Single Touch Payroll, please contact Murray Howlett, Jason Bayliss or Julie Bennett or your Pilot Advisor on 07 3023 1300.