Whether you’re a medical practitioner or a manufacturer; a retailer or a property developer; regardless of your industry or type of business, one of the biggest concerns of most business owners is whether or not there is enough money in the bank to keep their business running.

Planning and monitoring your cash flow is one of the most important things you can do.

A profit and loss statement and a balance sheet will give you a snapshot of what has happened. However, they won’t show you where you are or the future in terms of what funds are needed and where they are expected to come from.

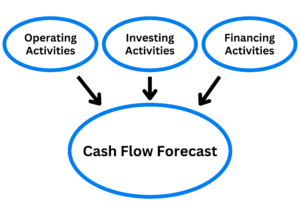

A cash flow forecast brings all elements of the business’ activities together:

Good cash flow management will allow you to:

- Track spending and stay on budget;

- Control inventory purchasing;

- Pay your suppliers on time or negotiate more favourable payment terms;

- Monitor late payers and improve credit control;

- Manage seasonal or project based income and expenditure;

- Manage payment of taxation obligations;

- Proactively manage cash shortages and surpluses;

- Apply for finance and comply with reporting obligations with your financier;

- Plan for growth;

- Plan for capital purchases;

- Pay dividends and distributions or generally take profits.

A cash flow forecast is an essential management tool to ensure sufficient cash is available to meet the needs of your business and achieve its objectives.

Learn More

If you would like to find out more about how a cash flow forecast would benefit your business, please contact a Pilot advisor on (07) 3023 1300 for more information.